I. Introduction

The International market of US hardwood products consist of a significantly diverse mix of customers from different regions around the world; where Canada, Mexico, Asia and Western Europe have played a central role in developing the US Hardwood Industry.

According to the U.S. Hardwood Export Statistics published by the American Hardwood Export Council (AHEC) and United States Department of Agriculture (USDA), the United States has been the World’s leading exporter of hardwood lumbers and veneers in the last 2 years, accounting for a total market share of 17% and 14% respectively during 2010. The country also played a key role in hardwood log exports between 2009 and 2010, holding a total market segment share of 22% and 20% respectively, surpassed only by Malaysia by approximately 1 percentage point.

The American Hardwood Export Council also indicated (AHEC, 2011) that China, Germany and Italy led the World’s wood furniture exports between 2008 and 2010, holding a 46% of total market, while United States only reported sales equivalent to a 2% of worldwide Exports throughout this time frame (9th place furniture exports).

During the last 6 years, the US exports of hardwood products have characterized by a predominance of primary/low value added goods such as logs and lumbers, over other more complex and higher value added products such as furniture, molding, floors, among others. In view of previous research, the exports of hardwood products will be vital for the US hardwood industry to survive . (Quesada-Pineda and Smith, 2010).

II. Study of US Hardwood Exports between 2007 and 2010

Figure 1 illustrates the total US Hardwood exports for the past 4 years. The Export business represented approximately $2,6 billion in revenue for US Economy in 2010, evidencing a shift on the declining trend suffered by US hardwood producers since 2007, when exports reached the level of $2,9 billion, down to $1,9 billion in 2009. According to Snow (2011), Executive director of AHEC, the US Hardwood Exports have demonstrated a consistent and steady growth since 1990, when income driven by business abroad generated approximately $1,0 billion, and reaching highest level of $2.9 billion of income in 2006.

Between 2007 and 2010, approximately 96% of US Hardwood Export market was concentrated in 5 main geographic regions: North America (Canada and Mexico), East Asia, European Union, Southeast Asia and Middle East. The North American market, comprised by Canada and Mexico, accounted for 33.4% of total exports, East & Southeast Asia for 33%, European Union for 27.2% and Middle East for an average of 2.5%; other regions represented the remaining 3.9% of US Hardwood exports.

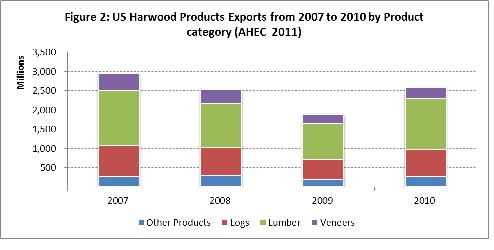

From a product category perspective, an average of 75% of US Harwood exports between 2007 and 2010 were driven by demand of lumber and, versus a 24% of exports of higher value added products, such as veneer, plywood, flooring, molding and siding products. Figure 2 depicts the pattern of US Hardwood exports since 2007 by product category.

According to Kretschmann (2010), in general “…the principal use of hardwood lumber is for remanufacture into furniture, cabinetwork, and pallets or direct use as flooring, paneling, molding, and millwork”. US hardwood lumber was exported to at least 70 countries around the world between 2007 and 2010, where mainly two countries: Canada and China accounted for an average of 45% of US lumber market (24% and 21% each country respectively), the third place was occupied by Italy with an average import yearly rate of 7.6% also between 2007 and 2010. Over the last four years, a total of $4,8 billion in exports for US Harwood Lumber was generated 6 wood species (out of the 13 exported): White Oak, Red Oak, Yellow Poplar, Maple, Ash and Walnut.

Exports of logs contributed with $2,5 billion to US hardwood business between 2007 and 2010, which placed this product category in second level of importance for US economy within hardwood ranking. Similarly to the US hardwood lumber export business; Canada, China and Germany have represented approximately 50% of the Market for US Hardwood logs since 2007; where most popular wood varieties have been White Oak, Red Oak, Walnut and Yellow Poplar (60% of US Hardwood Log Exports between 2007 and 2010) (AHEC, 2011).

Exports of US hardwood Veneer occupy the third place in importance, after lumber and logs, according to AHEC and USDA. US Hardwood Producers exported a total of $1,1 billion from 2007 to 2010. Canada has accounted for approximately the 41% of the market for US hardwood veneer since 2007, where other key customers such as Germany, Mexico, Spain and China represented an additional 30% of market during this timeframe. More than 80% of US hardwood veneer exports have been driven by the consumption of wood species such as Oaks, Maple, Walnut and Cherry.

The International market of US hardwood products consists of a significantly diverse mix of customers from different regions around the world; where North America, Asia and Western Europe are playing an instrumental role in developing the US Hardwood Industry.

Hardwood lumber exports are the number one selling hardwood product in overseas markets, followed by hardwood logs and veneers.

Most of US Hardwood Export market was concentrated in 5 main geographic regions in recent years: North America, East Asia, European Union, Southeast Asia and Middle East

III. Future work and research

The International market of US hardwood products consists of a significantly diverse mix of customers from different regions around the world; where North America, Asia and Western Europe are playing an instrumental role in developing the US Hardwood Industry. Hardwood lumber exports are the number one selling hardwood product in overseas markets, followed by hardwood logs and veneers Most of US hardwood export market was concentrated in 5 main geographic regions in recent years: North America, East Asia, European Union, Southeast Asia and Middle East

Much of the marketing research related to the trading of Hardwood products has focused on economic rather than social, cultural, or regulatory factors. Little has been done to understand how these factors impact the value chain of hardwood products. In a recent strategy focus meeting organized by the Hardwood Market Review in Charlotte, NC (HPC 2010): HD industries & associations all agreed that quality marketing research is needed to better understand the factors affecting the value chain of hardwoods in international markets.

Previous research indicates that Asia & Western Europe markets are full of potential opportunities for US hardwood producers for value-added products (Quesada-Pineda and Smith, 2010). The goal pursued in future research is to increase the exports of higher value products by capturing new market information using value chain analysis in traditional overseas US export markets. The outputs of this project will help US hardwood industries to develop stronger and more meaningful relationships with overseas customers. Traditional marketing research has helped uncover opportunities for improvement in US Hardwood products suppliers’ value proposition; therefore it is the intention of future research to determine factors that affect the developing of hardwood suppliers in the US industry.

References

- Quesada-Pineda, Smith (2010). “Analysis of Factors Impacting the International Value Chain of Hardwood Products: A Comparison between Asia and Western Europe”. USDA/FSMIP Grant Proposal.

- American Hardwood Export Council (AHEC, 2011). “US Hardwood Export Statistics: January – December 2010”. Available at <http://woodcomponents.org/app/portal/mm/AHEC2010TotalStats.pdf>. Last Accessed October 10, 2011

- American Hardwood Export Council (AHEC, 2010). “Products guide”. Available at <http://www.americanhardwood.org/videos-images-publications/publications/>. Last Accessed Oct 10, 2011

- Snow, Michael S. (2010). “2011 Hardwood Manufacturers Association National Conference Presentations: American Hardwood Export Council 2011 Activities”. Available at: <http://hmamembers.org/index.php?page=2011-hma-national-conference-presentations>. Last Accessed October 21, 2011

- Kretschmann, David E (2010). “Commercial Lumber, Round Timbers, and Ties Round Timbers. Wood handbook—Wood as an engineering material. General Technical Report FPL-GTR-190”. Available at < http://www.fpl.fs.fed.us/products/publications/several_pubs.php?grouping_id=100&header_id=p>. Last Accessed October 10, 2011