Blacksburg, VA. It took over 25 hours of CAD, CAM, and CNC work to manufacture five different molds that the VF FSAE team will be using to make the panels for its prototype racing car.

The VT FSAE has been competing for over 26 years and they finished 13th in last year competition. For 2014, the team’s goal is to quality for the International Formula SAE competition in Michigan where 120 other Universities and colleges will compete.

![]()

![]() The VT FSAE is composed of 33 students divided in seven teams including suspension, drivetrain, engine, electrical, aerodynamics, testing, and ergonomics. The final prototype car must be built under FSAE regulations and must past a through inspection before it is allowed to compete.

The VT FSAE is composed of 33 students divided in seven teams including suspension, drivetrain, engine, electrical, aerodynamics, testing, and ergonomics. The final prototype car must be built under FSAE regulations and must past a through inspection before it is allowed to compete.

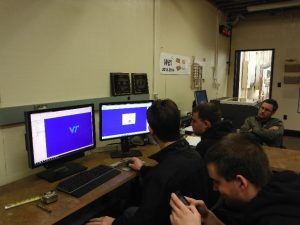

For 2014, the team is redirecting efforts to improve several of the car components, including the body. Hence, the team started a search to locate a large CNC equipment that could be used to cut the molds required for the body parts. The material used to cut the molds is a high density foam that is easy to manufacture. The WEI CNC equipment is just what the VT FSAE team needed and under the supervision of Dr. Henry Quesada the team quickly became familiar with the CAD/CAM software and the operation of the CNC machine.

For 2014, the team is redirecting efforts to improve several of the car components, including the body. Hence, the team started a search to locate a large CNC equipment that could be used to cut the molds required for the body parts. The material used to cut the molds is a high density foam that is easy to manufacture. The WEI CNC equipment is just what the VT FSAE team needed and under the supervision of Dr. Henry Quesada the team quickly became familiar with the CAD/CAM software and the operation of the CNC machine.

The way that the VT FSAE operates involves knowledge transfer from senior to freshman students, as key critical factor to be able to compete and complete the project which is very similar to the approach of WEI program at the Department of Sustainable Biomaterials.

The team structure is the following

- Team Leader: Vincent Sorrento

- Team Moderator: Dan Buckrop

- Team Facilitator: Nabeel Ahsan

- Sub-team structure

- Suspension

- Team Leader: Hannah Bever – Chassis

- Nabeel Ahsan, Taylor Turner – Uprights

- Alex Pape – Suspension design and geometry, springs, dampers, tires.

- Mike Lane – Suspension Structures

- Cody Kees – Bell cranks

- James Callaway – Steering

Drivetrain

- Team Leader: Mackenzie Hoover – Brakes

- Alex Coyle – Rear chunk

- Alex Girard – Shifting, Simulation

- Kyle Torrico, Thomas Barfield – Rotating components

- Brian McNulty – Wheel inners, wheel outers

- Danny Whitehurst – Half shafts, tripod bearings

Engine

- Team Leader: Dan Buckrop – Engine airflow, Intake

- Clay Brubaker – Controls, tuning

- Johnny Noble, Carter Moore – Oil, Fuel, Cooling

- Mark Anton – Engine airflow, exhaust

Electrical

- Team Leader: Bryce Crane – Telemetry, diagnostics

- Natan Diskin – Wiring

- Kori Price, Glenn Feinberg, Brian Kwan – Power stream, power budget module

- Tyler Diomedi – Packaging

- Daniel Ridenour – Graduate Assistant

Aerodynamics

- Team Leader: Stephen Young – Under tray, diffuser

- Sean Lynch, Chris van Oss – Wings

- James Bizjak – Structures

Testing

- Team Leader: Brian Oeters – Test Planning & Data Acquisition

- Akira Madono, Dylan Verster – Test Planning & Data Acquisition

Ergonomics

- Team Leader: Rachel White – Project management, cost analysis

- Eric Peterka, Jeff Petrillo – Pedal box

- Matt Marchese, Lucas Keese – Steering wheel, seats

- Sam Ellis – Cost analysis, facilities planning.

If you have any more questions about student CAD/CAM/CNC projects that the Department of Sustainable Biomaterials support, please contact Dr. Henry Quesada at quesada@vt.edu.