What are Engineering Change Orders (ECOs)?

ECOs are also called Engineering Change Notices (ECNs) or just Engineering Changes (ECs). ECOs are a significant driver of product development costs and lead time (Loch and Terwiesch 1999). Engineering changes (ECOs) refers to making design changes to an existing product (Barzizza, Caridi, and Cigolini 2001). It includes changes for improving production efficiency as well as the changes for assuring product quality and performance (Balakrishnan and Chakravarty 1996).

Types of ECOs

(Barzizza, Caridi, and Cigolini 2001) categorized ECOs as “scrap”, ”rework”, and ”use-as-is”. “scrap” means serious technical faults and user safety problem and needs to be solved immediately. “Scrap” will directly affect the work in progress (WIP) inventory since all these inventory cannot be applied to other products. ”Rework” means ECOs are required for improvements of pre-change WIP without affecting finished products and components. ”Use-as-is” means a product has no technical faults and user safety problem but need to improve product design.

Engineering Performance of Furniture Industry

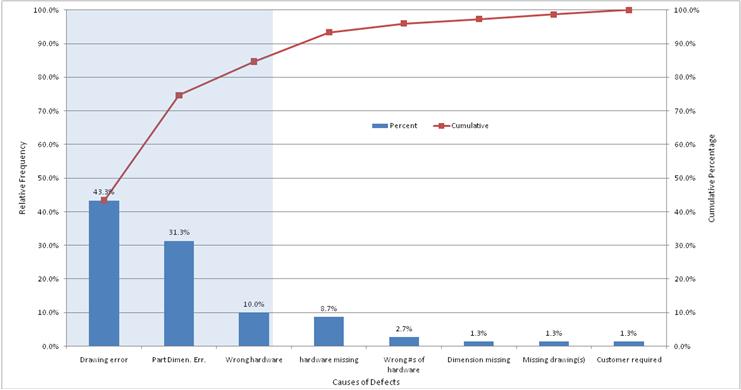

ECOs are also one of the reflections of engineering performance in the furniture industry. According to our interview, furniture engineers spend over 50% of their available engineering time on issuing ECOs for late design changes and architecture modifications. ECOs could be classified as ECOs for engineering errors and ECOs for engineering improvements. Less engineering errors could not only ensure product quality, but also could shorten the time-to-market and reduce the production cost. In order to find what are the most frequently occurred errors, a Pareto analysis could help us to have an idea on what the major contributors are. Figure 1 showed a Pareto Analysis of the engineering performance of a solid wood furniture company. The ECOs data represents a single month in that company. The number of ECOs issued for correcting engineering errors accounted for 98.67% of all the ECOS issued during this month. The rest 1.33% were ECOs for product improvements. From Figure 1, we could observe that “drawing error”, “part dimension error” and “wrong selection of hardware” take over 80 percent of the total engineering errors (most critical ones according to Paretto Analysis). Specifically, “drawing error” accounts for 44% of all the errors. Followings are” part Dimension Error” which accounted for 32%, “Wrong selection of hardware” accounted for 10%, “Hardware missing” accounted for 9%, “Wrong numbers of hardware” accounted for 3%, “Dimension missing” and “Missing drawings” both accounted for 1%.

Knowing what are the major causes of engineering error is important because ECOs (for correcting the engineering errors) are a type of waste which requires a lot of rework and iteration period. The Pareto Analysis can help us to find the major causes, and then we could try to find effective methods to eliminate these wastes.

Reference:

- Balakrishnan, N., and A. K Chakravarty. 1996. Managing engineering change: Market opportunities and manfucturing costs. Production and Operations Management 5, no. 4.

- Barzizza, R., M. Caridi, and R. Cigolini. 2001. Engineering change: a theoretical assessment and a case study. Production Planning & Control 12, no. 7: 717–726.

- Loch, C. H, and C. Terwiesch. 1999. Accelerating the process of engineering change orders: capacity and congestion effects. Journal of Product Innovation Management 16, no. 2: 145–159.